What Exactly Does a Financial Planner Do?

Summary

A financial planner evaluates your financial position, defines achievable goals, and develops strategies covering superannuation, investments, insurance, and tax efficiency. They undertake ongoing reviews and maintain accountability to ensure your financial decisions remain structured, compliant, and aligned with your long-term objectives under Australian financial advice standards.

Table of Contents

- Introduction

- What is the Role of a Financial Planner?

- What Are a Financial Planner’s Areas of Expertise?

- What Does a Financial Planner Do?

- What Does a Financial Planner Not Do?

- When to Get a Financial Planner?

- How Much Does Financial Planning Cost?

- What Regulation, Licensing, and Professional Standards Apply to Financial Planners?

- Do You Need a Financial Adviser?

- Is a Financial Planner Worth It?

- How to Choose a Financial Planner?

- Should You Choose an Independent or an Institution-Linked Financial Adviser?

- What is the Importance of Having a Local Financial Adviser?

- Conclusion

- FAQs

- Financial Planner Knowledge Bundle

Introduction

Many Australians engage a financial planner when their finances become too complex to manage confidently. Superannuation balances grow, investment options multiply, and life goals shift. A professional planner gives structure to that complexity and translates financial objectives into clear, actionable steps.

A licensed financial planner like James Hayes, based in Sutherland Shire, works closely with individuals and families to establish priorities, map out long-term strategies, and ensure that financial decisions work towards lifestyle and retirement objectives.

This article outlines what a financial planner does, how the process unfolds, and the standards that govern professional advice in Australia. Readers will also find reference links to more detailed resources within this series on financial advice, costs, regulation, and local services.

What is the Role of a Financial Planner?

A financial planner’s primary responsibility is to design and implement strategies that help clients manage, grow, and protect their wealth. The process generally unfolds in three stages, each supported by compliance obligations under Australian financial services law.

Stage 1: Assessment and Goal Definition

Every engagement begins with a thorough assessment of the client’s financial position: assets, liabilities, income, superannuation, investments, and insurance. From there, the planner and client define measurable objectives, such as

Achieving financial independence by a certain age

Preparing for retirement, or

Funding education for children

Stage 2: Strategy Formulation and Implementation

The planner prepares a Statement of Advice (SoA) that outlines recommendations to help meet those objectives. The document might include adjustments to super contributions, asset allocations, insurance coverage, or estate planning provisions.

Implementation follows only after client approval. It could involve coordinating with accountants, mortgage brokers, or solicitors to execute the recommended strategies.

Stage 3: Ongoing Review and Accountability

Financial advice is not a one-off transaction. Regular reviews ensure the plan remains sound amidst changing market conditions and personal circumstances. A planner’s ongoing role is to keep the client accountable and proactive and ensure consistency and discipline across time.

To learn about these stages in further detail, read The Financial Planning Process Explained.

Want a simple, plain-English overview of financial planning and what licensed advisers can and cannot do in Australia? Download James Hayes’ free explainer now.

What Are a Financial Planner’s Areas of Expertise?

Professional financial planning encompasses several specialised domains. Each operates within regulatory boundaries defined by ASIC and the Corporations Act 2001 (Cth).

James Hayes advises on these areas, which according to him, are things people cannot get excited about:

For more information on each service, please visit the respective pages.

What Does a Financial Planner Do?

Financial planners provide structured, licensed advice that integrates all aspects of a client’s financial life (superannuation, investments, insurance, tax efficiency, and estate planning) into a single coordinated strategy. Their work is analytical, documented, and subject to Australia’s financial services laws.

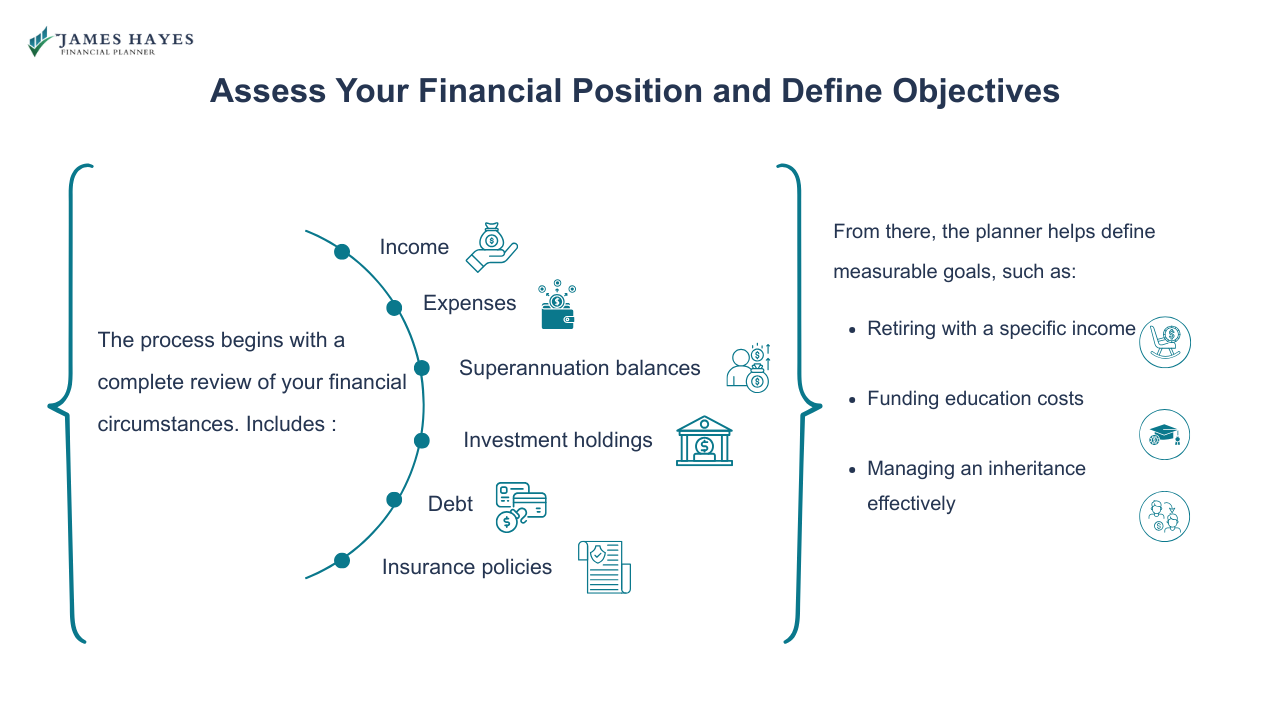

Assess Your Financial Position and Define Objectives

The process begins with a complete review of your financial circumstances. This includes income, expenses, superannuation balances, investment holdings, debt, and insurance policies. From there, the planner helps define measurable goals, such as retiring with a specific income, funding education costs, or managing an inheritance effectively.

Develop a Comprehensive Strategy

A financial planner designs a plan that connects all parts of your finances so they function cohesively. Each recommendation is formally documented in a Statement of Advice (SoA), a legal requirement under ASIC regulation. This outlines the rationale behind each step, projected outcomes, and associated risks.

Construct and Oversee Investment Portfolios

Planners use regulated research tools to design diversified portfolios that align with your risk profile, investment horizon, and income requirements. They monitor performance, recommend rebalancing when appropriate, and adjust strategies as market conditions or personal goals evolve.

Optimise Superannuation and Retirement Strategies

Advice typically includes fund selection, contribution timing, salary-sacrifice arrangements, and pension-income structuring. Planners model long-term outcomes, such as projected retirement income and life expectancy scenarios, to determine whether your current super settings are adequate for the lifestyle you want.

Analyse and Mitigate Financial Risk

Professional planners assess financial exposure to events such as illness, injury, redundancy, or death. They recommend insurance cover (life, total and permanent disability (TPD), income protection, and trauma) suited to your specific liabilities and dependants so that that financial obligations can still be met under stress.

Coordinate Estate Planning and Succession Measures

Financial planners work with solicitors to align your financial arrangements with estate documents. This ensures that wills, binding nominations, and powers of attorney reflect your broader strategy and that assets transfer efficiently and tax-effectively to intended beneficiaries.

Maintain Ongoing Oversight and Accountability

Financial planning is an ongoing process. Planners review portfolios, monitor super and insurance performance, and update strategies as legislation or personal circumstances change. Regular review meetings encourage accountability and allow clients to stay informed and confident that their plan remains compliant and effective.

From ASIC oversight to FASEA ethics, James Hayes’ Do & Don’t Explainer Guide clears up the myths, outlines legal boundaries, and shows you exactly how to tell real advisers from unlicensed operators. Get it now.

What Does a Financial Planner Not Do?

Understanding the limits of professional financial advice is just as important as knowing what it includes. Licensed financial planners operate under strict obligations set by the Corporations Act 2001 (Cth) and overseen by the Australian Securities and Investments Commission (ASIC). Certain requests fall outside that regulated scope.

Handle Centrelink or Early Super Withdrawals

Centrelink and superannuation release applications are government-administered matters. Financial planners cannot facilitate early access to super unless the client meets formal hardship or compassionate-grounds criteria and lodges the application directly with the ATO or their fund. James Hayes does not help with Centrelink benefits or super withdrawals.

Provide Free or Deferred Advice

Comprehensive financial advice requires research, compliance documentation, and professional liability coverage. For this reason, legitimate advice is fee-based. If a service claims to be “free,” it is likely subsidised by product sales or commissions—an approach now largely banned under the Future of Financial Advice (FOFA) reforms.

Replace Accountants or Lawyers

Financial planners coordinate closely with accountants and solicitors but do not prepare tax returns or draft legal documents. Their role is to ensure that investment, tax, and estate structures complement each other, not to duplicate the functions of other professionals.

Promise Investment Performance

Market outcomes are inherently variable. A planner’s role is to design and manage risk-adjusted strategies, not to forecast returns or guarantee outcomes. Every recommendation must be evidence-based, compliant, and consistent with your stated objectives and risk tolerance.

Operate Outside Regulatory Oversight

Every licensed adviser must hold, or be authorised under, an Australian Financial Services Licence (AFSL). Advisers must appear on ASIC’s Financial Adviser Register, meet education and ethical standards, and maintain professional indemnity insurance. If an adviser cannot demonstrate these credentials, they are not authorised to provide financial advice in Australia.

Work for Banks or Product Providers (If Independent)

Independent advisers like James Hayes are self-employed and not institutionally obliged. They are not incentivised by product sales or internal targets, which allows their advice to remain transparent, client-focused, and conflict-free.

From ASIC oversight to FASEA ethics, James Hayes’ Do & Don’t Explainer Guide clears up the myths, outlines legal boundaries, and shows you exactly how to tell real advisers from unlicensed operators. Get it now.

When to Get a Financial Planner?

Engaging a financial planner is most valuable at times of transition: career change, inheritance, family expansion, or retirement planning. Structured advice provides three key outcomes:

Strategic clarity: A documented plan with defined milestones.

Time efficiency: Complex financial administration delegated to a professional.

Confidence and continuity: Assurance that decisions are compliant, measured, and regularly reviewed.

For a closer discussion on timing and suitability, refer to When to Get Financial Advice.

How Much Does Financial Planning Cost?

Advisory fees vary according to complexity and service scope. Common models include:

Fixed project fees

Hourly consulting rates, and

Ongoing retainer arrangements

Transparent, fee-for-service models eliminate commission conflicts and clearly define deliverables.

Prospective clients should always request a written fee disclosure and engagement letter outlining inclusions and review frequency.

A full breakdown of pricing models and cost expectations is detailed in What Does Financial Advice Cost in NSW?

What Regulation, Licensing, and Professional Standards Apply to Financial Planners?

Australian financial planners operate under a tightly regulated framework overseen by the Australian Securities and Investments Commission (ASIC). Advisers must hold or operate under an Australian Financial Services (AFS) licence and comply with the Corporations Act 2001 (Cth) and ASIC’s financial product advice regulations.

Professional standards also require tertiary qualifications, ongoing education, and ethical certification through recognised bodies such as the Financial Advice Association Australia (FAAA). Many practitioners pursue the Certified Financial Planner (CFP) designation, recognised as the industry’s highest global credential.

Clients can verify an adviser’s status on ASIC’s Financial Adviser Register or confirm complaint resolution coverage through the Australian Financial Complaints Authority (AFCA).

More detail is available in Financial Adviser Regulation & Licensing (ASIC/AFSL/CFP) Explained.

Do You Need a Financial Adviser?

That decision rests entirely with you. The role of a planner is not to convince but to clarify. James’ objective is to help you see your situation clearly—your income, assets, liabilities, goals, and time horizon—and then decide whether professional advice will materially improve your outcomes.

If you can ably manage your own investments, tax considerations, and retirement planning, that’s a valid choice. If you prefer structure, accountability, and technical support, professional advice may be worth exploring.

In case you’re weighing up whether advice is right for you, James Hayes’ What Financial Planners Do & Don’t Explainer offers a simple breakdown of what regulated planners can help with—and what falls outside their scope. Get it today to make an informed decision.

Is a Financial Planner Worth It?

The value of professional advice depends on what you expect from it. Many of James’ clients find that advice saves time, prevents costly errors, and gives crystal-clarity to their financial lives. Others simply gain the peace of mind that every decision is documented, compliant, and strategically aligned.

Ultimately, the worth of advice is determined by outcomes and tangible progress toward financial independence.

How to Choose a Financial Planner?

Choosing a financial planner requires the same diligence as selecting any professional partner.

Verify credentials through ASIC and professional associations.

Review experience relevant to your circumstances.

Understand the service model—comprehensive, ongoing, or single-issue.

Clarify fees and engagement scope before signing any agreement.

Comprehensive checklists and questions to guide your selection are provided in How to Choose the Right Financial Adviser. To avoid errors in judgment, also review Common Mistakes When Choosing Financial Advisers.

Should You Choose an Independent or an Institution-Linked Financial Adviser?

Not all financial advisers are independent. Those employed by banks or large institutions may be limited to recommending in-house products. An independent planner like James Hayes operates without institutional alignment and dispenses advice solely in the client’s interest.

An explanation of independence and fee structures appears in Independent vs Institution-Linked Financial Advice.

What is the Importance of Having a Local Financial Adviser?

Financial advice benefits from local context. Economic conditions, property markets, and community demographics vary across regions. Working with a Sutherland Shire-based financial adviser gives you accessibility for in-person meetings and guarantees familiarity with local investment trends, council regulations, and retirement needs.

For those seeking a nearby professional, see Why Choose a Local Financial Planner?

Conclusion

A qualified financial planner brings order, discipline, and foresight to personal wealth management. Beyond spreadsheets and projections lies an advisory relationship grounded in professionalism, accountability, and ethical responsibility.

For clients in Sydney’s CBD and Sutherland Shire, James Hayes offers independent, transparent, and personally tailored financial planning. His process combines technical precision with clear communication so that clients understand every recommendation before implementation.

Schedule a free 15-minute introductory consultation on Calendly to understand how his structured financial advice can strengthen your financial position and long-term security.

FAQs

-

The initial step is understanding your full financial position: assets, income, debts, and goals. I use that information to build a structured plan that prioritises your objectives and provides a clear direction for managing, protecting, and growing your wealth.

-

I review every client’s plan at least quarterly, or sooner if major life or market changes occur. Regular reviews keep strategies relevant and ensure decisions continue to match your financial objectives and current legislation.

-

Not at all. I advise clients at every stage, from professionals building wealth to retirees managing income streams. The key is timing your financial decisions early enough to benefit from long-term strategy and compounding growth.

-

I base recommendations on risk tolerance, investment horizon, and your defined goals. Each strategy is evidence-based, diversified, and fully explained before implementation because you need to understand both the rationale and potential outcomes.

-

I operate independently, without product commissions or institutional influence. Every recommendation is made solely in your best interest, under ASIC regulations, with complete transparency on fees, products, and performance review processes.

Financial Planner Knowledge Bundle

- What Exactly Does a Financial Planner Do?

- Financial Advice vs Financial Planning

- Independent vs Institution-Linked Financial Advisers

- What Does Financial Advice Cost in NSW?

- How to Choose the Right Financial Adviser in Australia

- When to Get Financial Advice in Australia

- What Areas Do Financial Planners Cover?

- Online Financial Planning Services

- Financial Planning Process Explained

- Common Mistakes When Choosing Financial Advisers

- Certified Financial Planner (AFP®/CFP®) Explained

- Financial Adviser Regulation & Licensing (ASIC/AFSL) Explained

- Local Financial Planning Services in Sutherland Shire

Disclaimer

The information in this article is provided as a general guide only. It does not constitute personal financial advice and should not be relied upon as such. Readers should seek advice from a licensed financial adviser before making any financial decisions. James Hayes and his associated entities accept no responsibility or liability for any loss, damage, or action taken in reliance on the information contained in this article. Links to third-party websites are provided for reference purposes only. We do not endorse or guarantee the accuracy of their content.